Welcome to the first Equiduct in Italia newsletter

January 2022

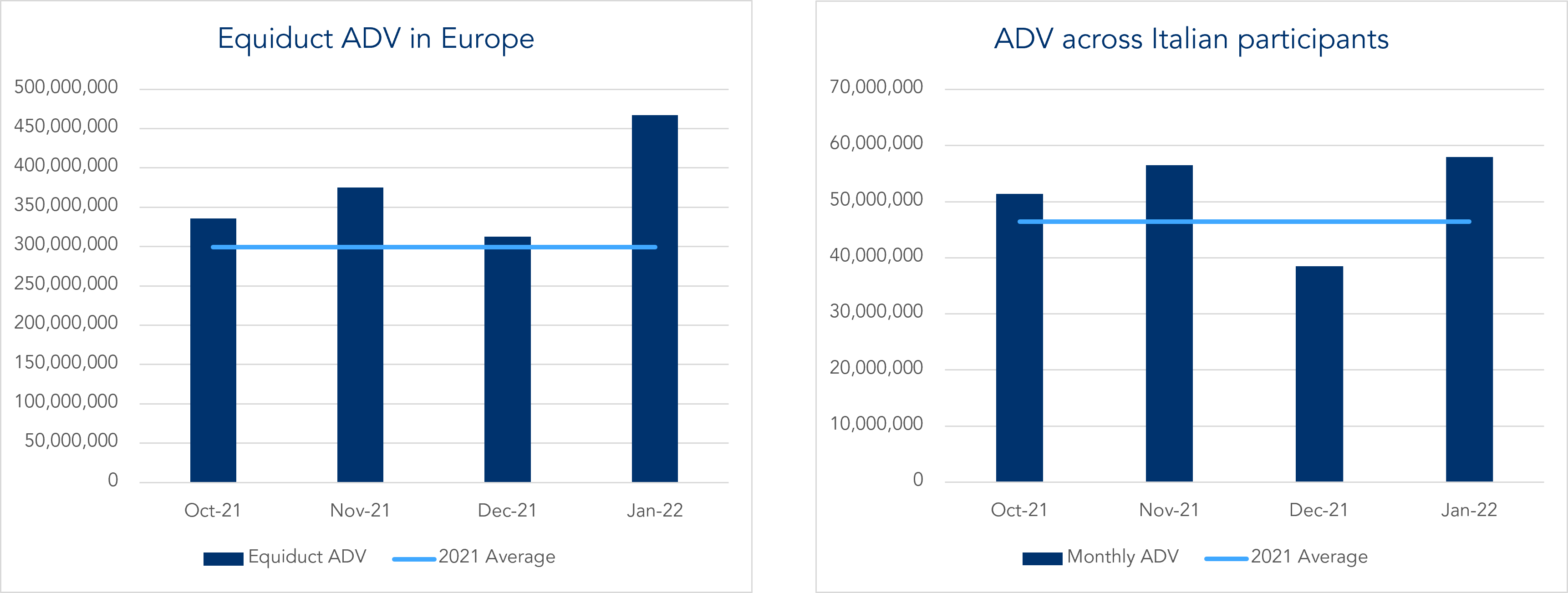

We are excited to launch our Italian newsletter and share with you some of the key trading information for Equiduct in January 2022. As this is our first newsletter, we would like to first recap what great successes we have seen in 2021:

Here’s a summary of what we have seen in Equiduct over the month of January 2022 and Q4 2021

Equiduct's ADV progression overall and contribution from Italy

Our top traded Italian stocks

Execution quality analysis of Italian instruments on Equiduct

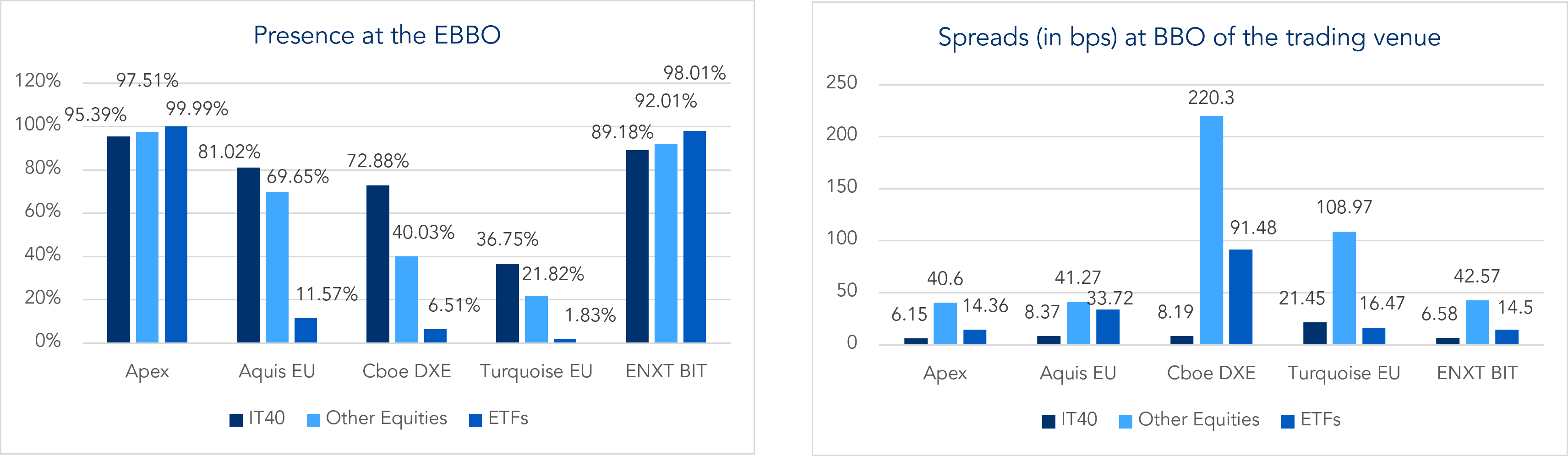

Q4 2021 data, obtained and analysed by smart data and analytics company, big xyt, which is an independent and fully neutral market data analytics provider.

Price formation on Equiduct (for Italian instruments) uses liquidity available on Borsa Italiana, CBOE Europe, Turquoise Europe and Equiduct’s own CLOB.

As a result, execution prices on Equiduct will always be better or equal to those achievable on Borsa Italiana. The analysis below looks at the IT40 Index, 53 other equities and 248 exchange traded funds (ETFs).

Looking into the future

We have many new developments in our pipeline! We are looking forward to announcing soon

further geographical expansion of our universe and new exciting ETFs.