Welcome to the first Equiduct Last Month newsletter

February edition

We are very excited to launch our Equiduct Last Month newsletter and share with you some of the key trading information for Equiduct in February 2022. As this is the first newsletter, below is just a brief recap of the great successes seen in 2021 and across to the first months of 2022:

Here are a few highlights from the month of February 2022

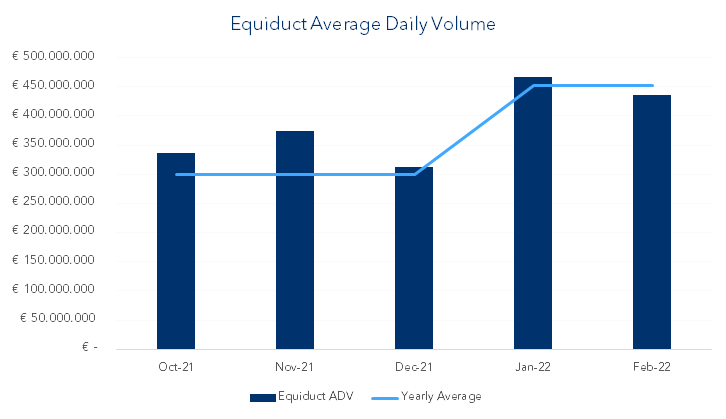

ADV progression over Q4 2021 and Q1 2022 to-date

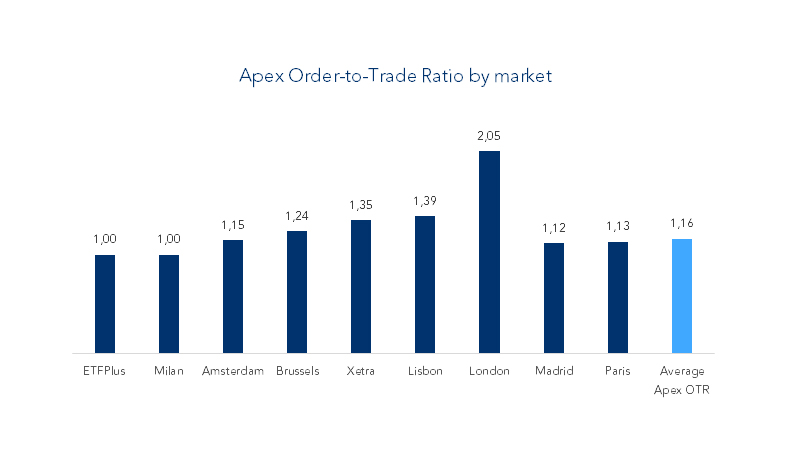

Apex Order-to-Trade Ratio

Top traded stocks at Equiduct

| Instrument ID | Instrument Name | Trading Market | Equiduct Turnover | European turnover | Equiduct Market Share |

|---|---|---|---|---|---|

| ORPp | Orpea | Paris | € 308.219.150 | € 1.705.477.802 | 18,1% |

| BBVAe | Banco Bilbao Vizcaya Argentaria | Madrid | € 194.111.186 | € 4.244.254.013 | 4,6% |

| INGAa | ING Group | Amsterdam | € 192.664.676 | € 7.876.705.627 | 2,4% |

| TTEp | TotalEnergies | Paris | € 186.760.253 | € 11.782.083.261 | 1,6% |

| SHELLa | Shell | Amsterdam | € 182.142.024 | € 9.216.405.981 | 2,0% |

| BNPp | BNP Paribas | Paris | € 180.989.747 | € 9.448.913.109 | 1,9% |

| MTa | ArcelorMittal | Amsterdam | € 178.552.390 | € 5.245.191.583 | 3,4% |

| ASMLa | ASML Holding | Amsterdam | € 177.324.511 | € 14.146.626.146 | 1,3% |

| GLEp | Société Générale | Paris | € 175.193.106 | € 5.525.930.608 | 3,2% |

| MCp | LVMH Moët Hennessy Louis Vuitton | Paris | € 151.649.114 | € 9.751.829.435 | 1,6% |

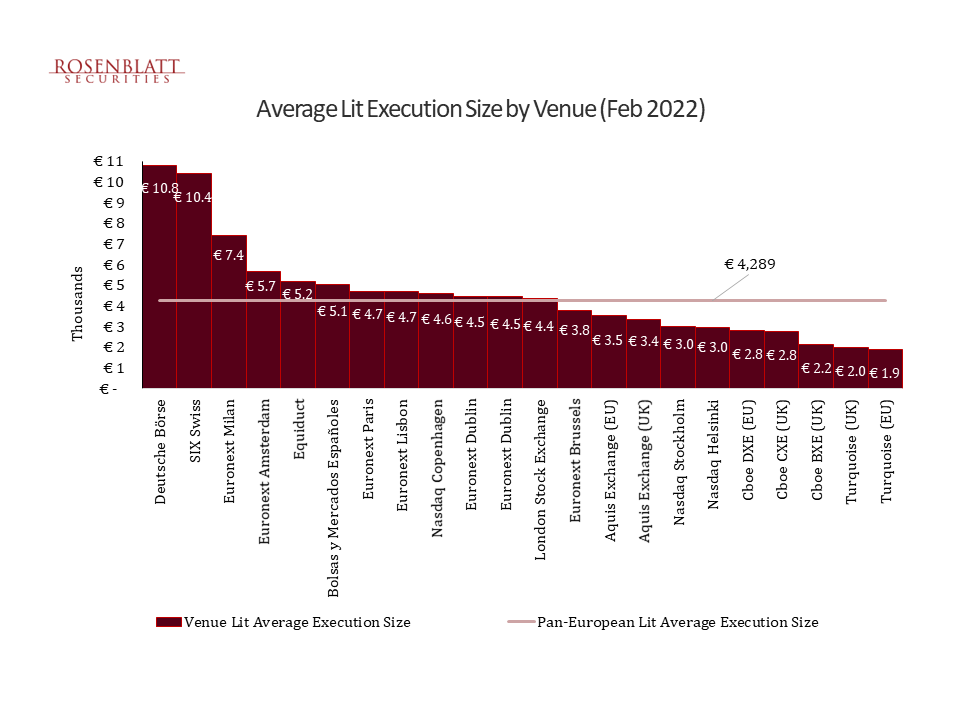

Average Lit Execution Size by Venue

In February, Equiduct’s execution size is higher than the pan-European lit average execution size, as highlighted by Rosenblatt Securities’ chart below.

Looking into the future

We have many new developments in our pipeline! We are looking forward to announcing soon further geographical expansion of our universe and new exciting ETFs and ETPs.