Our commitment is to retail investors – always.

We exist to help retail investors gain access to European markets in a fragmented landscape and to deliver user-friendly Best Execution for those investors.

We believe that it is the responsibility of the exchanges to do more to deliver the goals set out in MiFID for retail investors.

By democratising access to Best Execution, we are leading positive change in pan-European trading, as part of our ongoing commitment to retail investors.

Find out more about our purpose and mission statement

What is Payment for Order Flow?

Payment for Order Flow – also known as PFOF – is defined as an arrangement whereby a broker receives payment in exchange for sending order flow to a specific counterparty.

PFOF has received a lot of attention as a result of news stories about trading in “meme stocks” driven by Reddit forums and lockdowns in the United States, during the Covid-19 pandemic. With this, European regulators have started to look at what this could mean for retail investors in Europe.

What is ESMA’s statement on PFOF?

ESMA’s public statement highlighted the fact that the receipt of PFOF by firms from third parties would not be compatible with MiFID II, as it incentivises those firms to choose the third party offering the highest payment, rather than the best possible outcome for its end clients when executing their orders.

Therefore, when choosing their execution venue, firms need to ensure that they comply with local and international rules and regulations, and deliver Best Execution.

Brokers connected to Equiduct provide their clients with access to best execution on a multilateral, regulated market which prioritises the interests of their end clients, the retail investor.

How we stand with retail investors in support of ESMA’s position

Improving execution quality and the investment experience is at the heart of everything we do.

So how do we stand with retail investors in light of ESMA’s position regarding PFOF?

Our credentials and regulatory operation

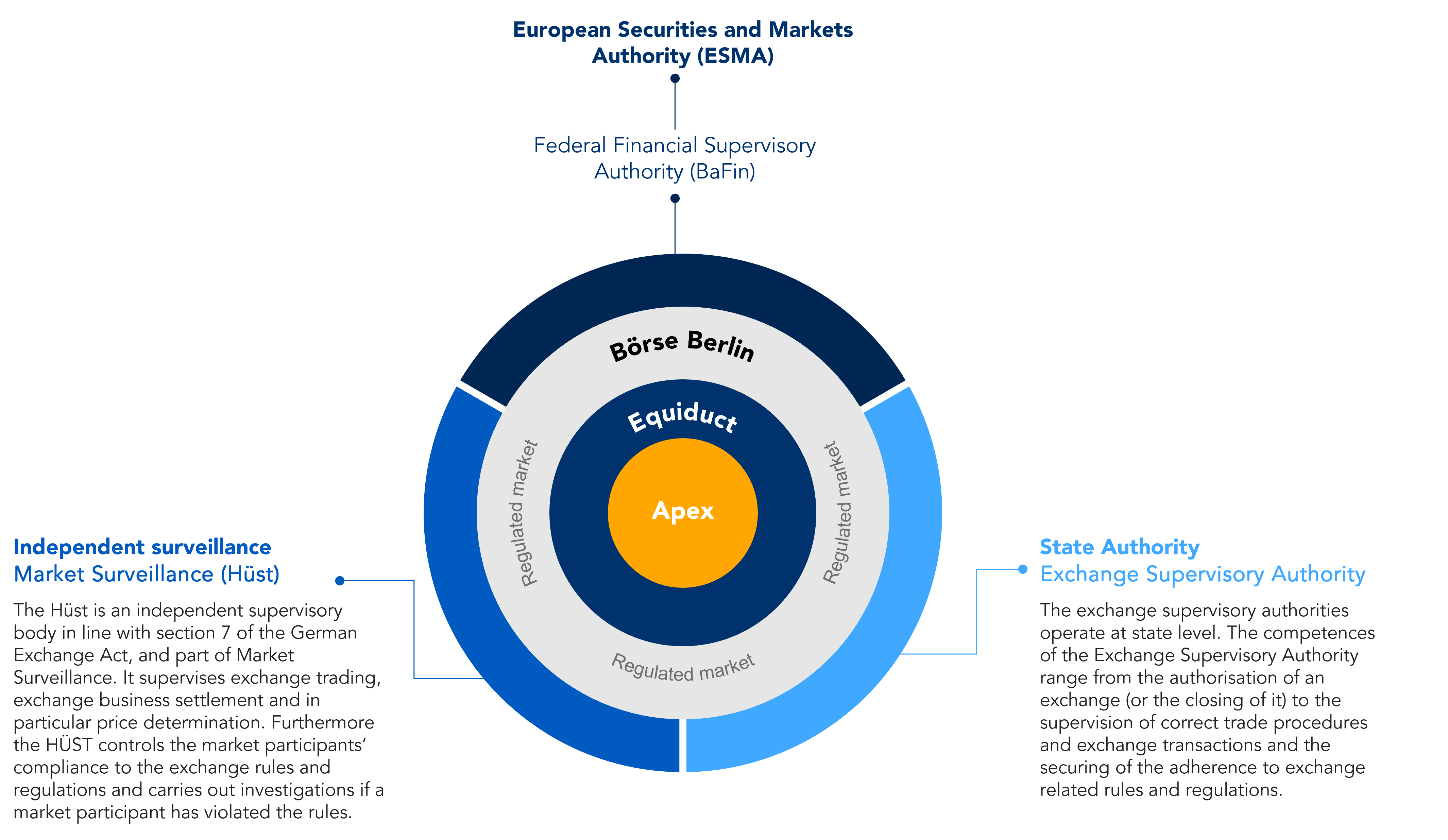

We are a pan-European exchange and Regulated Market. We operate under the regulatory license of Börse Berlin and provides pan-European Best-Execution services and market data on fragmented Equities and ETFs.

We operate as a regulated market (commonly referred to as an Exchange) in the context of a post MiFID II trading environment, offering access to all major primary and secondary market liquidity in Europe using a single exchange connection.

Our clients receive daily Best Execution reports in accordance with MiFID best practices.

Furthermore, we operate under a highly regulated ecosystem:

Diventa un membro aderente

Vuoi unirti a noi? Scopri di più sulle opzioni di adesione ai nostri servizi.